As a forensic accountant, I have been asked by many clients what the main difference is between a forensic accounting engagement and an audit. A forensic accounting engagement applies accounting, auditing, and investigative skills to examine, analyze, and report on financial information in a manner suitable to the court. An audit is performed by an internal or external auditor, who must adhere to a certain set of standards established by the American Institute of Certified Public Accountants.

Forensic accounting services are usually necessary when there is a dispute or lawsuit already in place. We are often asked by the client’s attorney to assist in the litigation process as an expert. The goal of the forensic accountant is to analyze, report, and assist the court in understanding the financial aspects of the case. At my firm, the most common types of cases we work on are: ponzi schemes, embezzlement fraud, damages, estates, and bankruptcy analysis.

Clients also engage us, as forensic accountants, when they suspect somebody is misappropriating funds from their businesses. During these engagements, we analyze the financial information, interview employees, and help them implement effective internal controls for their businesses. Unfortunately, many of the smaller businesses don’t have adequate internal controls in place and employees take advantage and misappropriate assets. Very often we uncover that the fraud was performed by a long time trusted employee or someone in a management position.

Audits are engagements that examine and evaluate the financial statements of any given organization. An audit’s objective is to provide assurance, to the intended user, that the information contained in those financial statements is a fair and accurate representation of the organization. Audits are regulated and must follow the Generally Accepted Auditing Standards.

One of the main differences between an audit and a forensic accounting engagement is that the audit program is designed to provide assurance that certain parts of the financial statements are reasonable and a forensic accounting engagement is designed to analyze a specific set of transactions or to search for misappropriated assets.

For example, audits may establish a threshold of materiality where forensic accounting engagements don’t have a materiality threshold. In the field of forensic accounting, every act or evidence of suspicious activity is material.

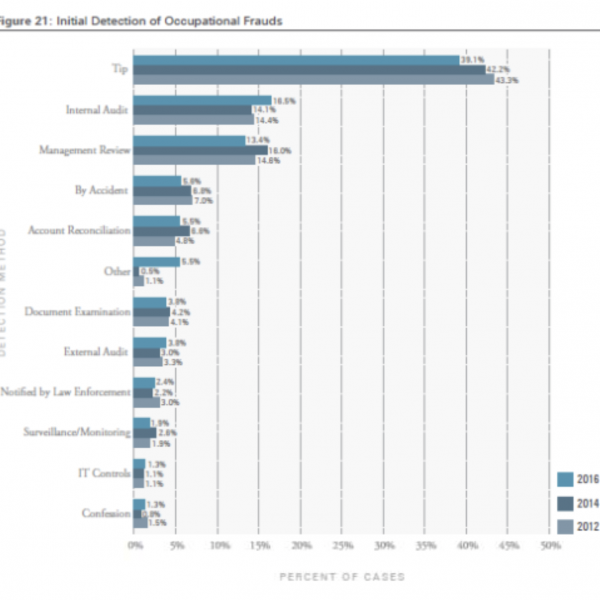

Audits often fail to detect fraud that is below the materiality level established by the auditor performing the engagement. According to the Association of Certified Fraud Examiners “Report to the Nations,” in 2016 only 3.8% of all occupational frauds were detected by external audits. (See figure below)

Although, forensic accounting and auditing professionals utilize the same accounting skills, the purposes of the engagements are different. For that reason, it is important that we explain to our clients the difference and understand our clients’ needs, so that we can provide better advice about the type of engagement that will benefit them the most.

Veronica Larriva, CPA